Chickens and Eggs

We sometimes hear software applications or systems referred to as solutions in search of problems. Up to a certain point, that didn’t seem to be an issue for the insurance industry. Starting around the time of Y2K, insurance technology was focused on automating, simplifying, and eliminating the manual tasks and paper involved in processes like underwriting, billing, building pricing models based on broad actuarial tables, and claims adjudication.

But that certain point seems to have been around 2015 when the term, insurtech, was coined to describe startups and technologies that aimed to enter the insurance industry with digital tools like big data, AI, and mobile apps to make processing and acquiring insurance faster, cheaper, and more user-friendly. Venture capitalists entered the market, betting on personalized policies, usage-based insurance (UBI), and blockchain for fraud prevention. Since many of the insurtechs were founded by people outside of the insurance industry, they struggled with regulatory hurdles and building trust. And according to Failory, the initial failure rate for insurtechs was 50 to 65 percent within their first few years, based on broader tech startup failure rates and specific insurtech challenges.

But they didn’t go away.

Evolution

Challenges like regulations, data privacy, and integration with legacy systems slowed the progress of insurtechs. But overcoming those challenges bought the survivors time. By 2025, insurtechs were becoming core parts of the ways in which insurance worked. In hindsight, insurtech’s story since 2015 is a slow reshaping of an ancient industry. In that way, insurtechs recall Thomas Kuhn’s 1961 book, The Structure of Scientific Revolutions, in which he introduced the concept of paradigm shifts — moments when established frameworks are upended by new ways of thinking. Applying Kuhn’s lens to insurtechs, we can see them as agents of such a shift within the insurance industry.

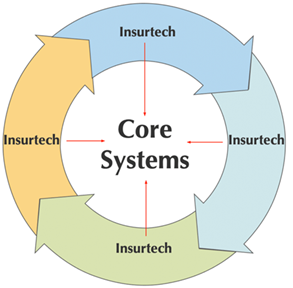

In Kuhn’s terms, traditional insurance operates under a long-standing normal science paradigm: a system of actuarial tables, risk pools, and bureaucratic processes refined over decades. Insurtechs could be seen as introducing anomalies — new tools and approaches that challenge the efficiency, accessibility, and assumptions of the old paradigm. Over time, many insurtechs are simply being absorbed into the existing paradigm, enhancing it without overthrowing it, in a model that might look like this:

What Came First?

Kuhn might also note the social dynamics. Paradigm shifts aren’t just about tech — they require a community of practitioners to embrace the change. If insurtechs continue to gain ground with regulators, carriers, and policyholders, they could tip the scales. If not, they’ll remain fringe experiments. But until history sorts it out, we can’t know.

Nevertheless, it’s easy enough to imagine some point in the future at which today’s core-processing systems and insurtechs might be seen as so many chickens and eggs. And we won’t care what came first.